PA UC-1208 2014 free printable template

Show details

PENNSYLVANIA UNEMPLOYMENT COMPENSATION (UC) BENEFITS ADDRESS CONFIRMATION AND POWER OF ATTORNEY DEPARTMENT OF LABOR & INDUSTRY OFFICE OF UNEMPLOYMENT COMPENSATION BENEFITS Employer name PA UC Account

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA UC-1208

Edit your PA UC-1208 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA UC-1208 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA UC-1208 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA UC-1208. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA UC-1208 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA UC-1208

How to fill out PA UC-1208

01

Obtain the PA UC-1208 form from the Pennsylvania Department of Labor and Industry website or an authorized office.

02

Fill in your personal information, including your name, Social Security number, and contact details.

03

Provide the reason for your request in the designated section.

04

Ensure all information is accurate and complete to avoid delays.

05

Sign and date the form at the bottom.

06

Submit the completed form according to the provided instructions, either by mail or electronically, if applicable.

Who needs PA UC-1208?

01

Individuals who have been denied unemployment benefits and wish to appeal the decision.

02

Claimants who need to provide additional information or documentation supporting their claim.

03

Workers who are seeking a review of their unemployment compensation eligibility.

Fill

form

: Try Risk Free

People Also Ask about

What is the taxable wage base for unemployment in PA 2023?

Taxable Wage Base for Calendar Year 2023 The taxable wage base is $10,000 per employee per calendar year.

What is the wage base for unemployment in PA?

The SUI wage base for 2023 remains unchanged at $10,000. For information concerning SUI tax rate relief for businesses closed due to the state's COVID-19 emergency declaration, see EY Tax Alert 2022-1874.

How long does it take to get a determination letter from unemployment in PA?

Financial determination letters are typically received within 3 business days via your UC Dashboard communication preference. Your financial determination letter will tell you: Your benefit year begin date AND the date your benefit year expires.

What is the taxable wage base for PA unemployment?

Wages subject to Unemployment contributions have increased to $39,800 in 2022 and will increase to $41,110 for the 2023 fiscal year.

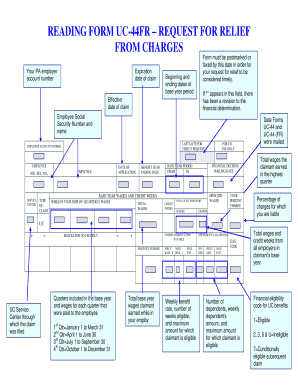

How do I file a relief from charges in PA?

You may e-mail or fax a request for relief from charges to the department. If you use Form UC-44FR and send it by fax, both sides of the form must be faxed. Whether you use the form or a letter, include the claimant's name and social security number and the employer's name and UC account number on all faxed pages.

What is Section 302.1 A )( 1 of the PA UC law?

Section 302.1(a) of the PA UC Law provides that employers may request relief from certain benefit charges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete PA UC-1208 online?

With pdfFiller, you may easily complete and sign PA UC-1208 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the PA UC-1208 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your PA UC-1208 and you'll be done in minutes.

Can I edit PA UC-1208 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign PA UC-1208. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is PA UC-1208?

PA UC-1208 is a form used in Pennsylvania for reporting unemployment compensation taxes and wages.

Who is required to file PA UC-1208?

Employers in Pennsylvania who pay wages to employees and are subject to unemployment compensation tax are required to file PA UC-1208.

How to fill out PA UC-1208?

To fill out PA UC-1208, employers must provide information regarding their business, employee wages, and the unemployment compensation tax liability for the reporting period.

What is the purpose of PA UC-1208?

The purpose of PA UC-1208 is to report employment wages and unemployment compensation tax liabilities to the Commonwealth of Pennsylvania's Department of Labor and Industry.

What information must be reported on PA UC-1208?

The information that must be reported on PA UC-1208 includes the employer's identification details, total wages paid, number of employees, and the calculation of the unemployment compensation tax owed.

Fill out your PA UC-1208 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA UC-1208 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.